Corticeira Amorim: money does grow on trees

The world's cork leader looks primed for a rerating. This is the overlooked materials growth story.

Cork is graduating from stopper to frontier material. Corticeira Amorim’s moonshots—climate-grade building insulation, EV battery thermal barriers and NVH, vibration-damping composites, aerospace heat shields, and carbon-capture adjacencies—turn a heritage business into a spec-driven platform. Margin recovery into 2026 funds the push; “Cork Solutions” concentrates R&D and go-to-market where policy and OEM specs create sticky demand. If even two of these vectors scale, mix and multiples rise. Optionality includes advanced coatings and circular carbon.

Cork’s Next Act: From Stopper to Spec Platform

1) The Thesis — A bio-material steps into spec

Cork is graduating from stopper to frontier material. Corticeira Amorim’s edge is pragmatic, not hype: scale forestry access, process know-how, and quality systems now pointed at higher-spec use cases. The aim is simple—lift mix and resilience by earning a place in regulated, engineered applications. If even two non-stopper vectors scale, earnings quality and multiples rise.

2) The Moonshots — Where cork could win

Climate-grade insulation: Bio-based boards for façade/roof retrofits, valued for thermal + acoustic performance and circular CO₂. Policy tailwinds create steady bid; specs can lock for years.

EV battery safety & NVH: Thermal/fire-barrier layers and vibration damping where density, resilience, and heat behavior matter. Platform adoption = sticky, multi-year revenue.

Aerospace heat shields & damping: Cork ablatives/damping in launch systems; niche but high-margin, qualification-driven, brand-defining.

Industrial gaskets & pads: Rubber-cork blends for utilities/process industries; OEM standards create annuity-like replacement cycles.

Circular carbon & advanced coatings (optionality): Early projects that could bolster ESG pricing power and open premium design channels.

3) Why now — Timing, catalysts, proof

Margin recovery into 2026 funds the push: harvest-cost normalization plus targeted opex savings should add ~200–300 bps to EBITDA. The new “Cork Solutions” unit concentrates R&D and go-to-market where standards and certificates win the sale—retrofit programs, EV platforms, and space supply chains. What to watch over the next 2–3 quarters: 1) named spec wins or pilot conversions; 2) order intake in insulation/composites; 3) EBITDA marching toward ~19–20%; 4) leverage holding ~1.2–1.3× with dividend carry.

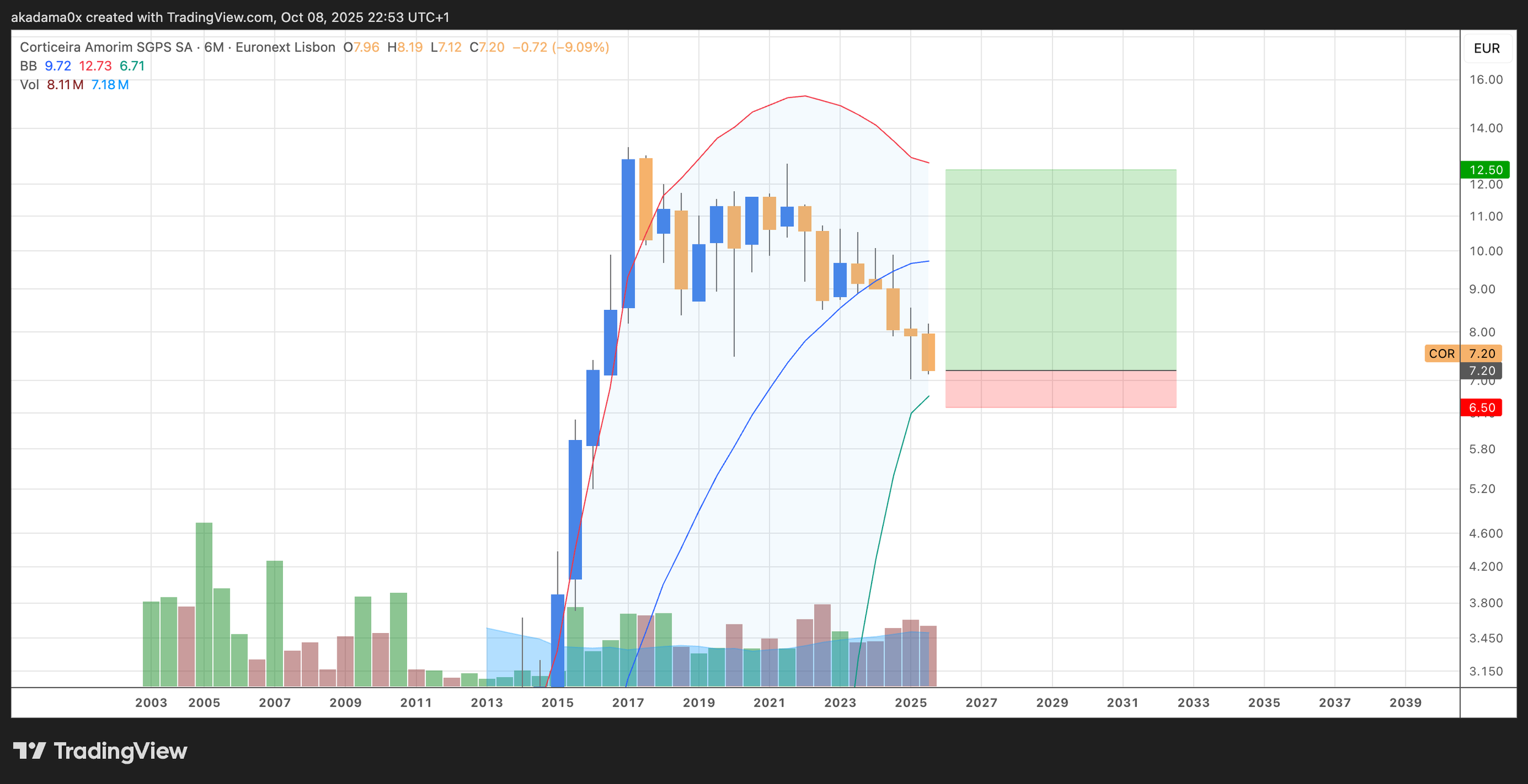

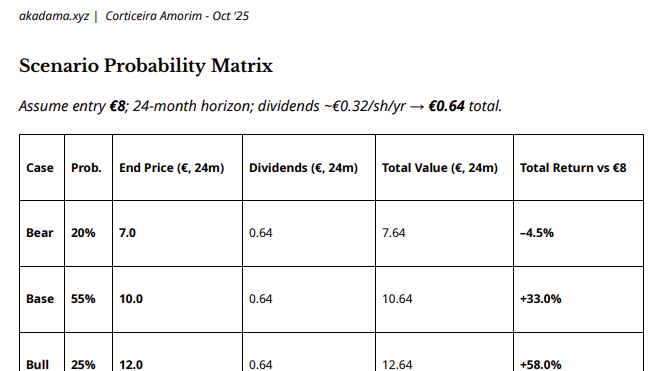

4) Positioning — Disciplined upside, clear guardrails

Base fair-value band €9–11 (mid ~€10) versus an add zone ≤€8; trim ≥€11–12 if execution stalls. The setup is skew-positive: closures cash flow underwrites the option to scale new lines, while risk control is explicit—flip the call if EBITDA <16% for two quarters, ND/EBITDA >1.5× without a plan, or premium closures lose ~5pp share. The rerating case is straightforward: show two credible specs landing, keep margins on plan, and let the market price a less wine-linked, more spec-driven business.

Trade setup with risk/reward parameters for COR with entry at the current price of 7.20 EUR.