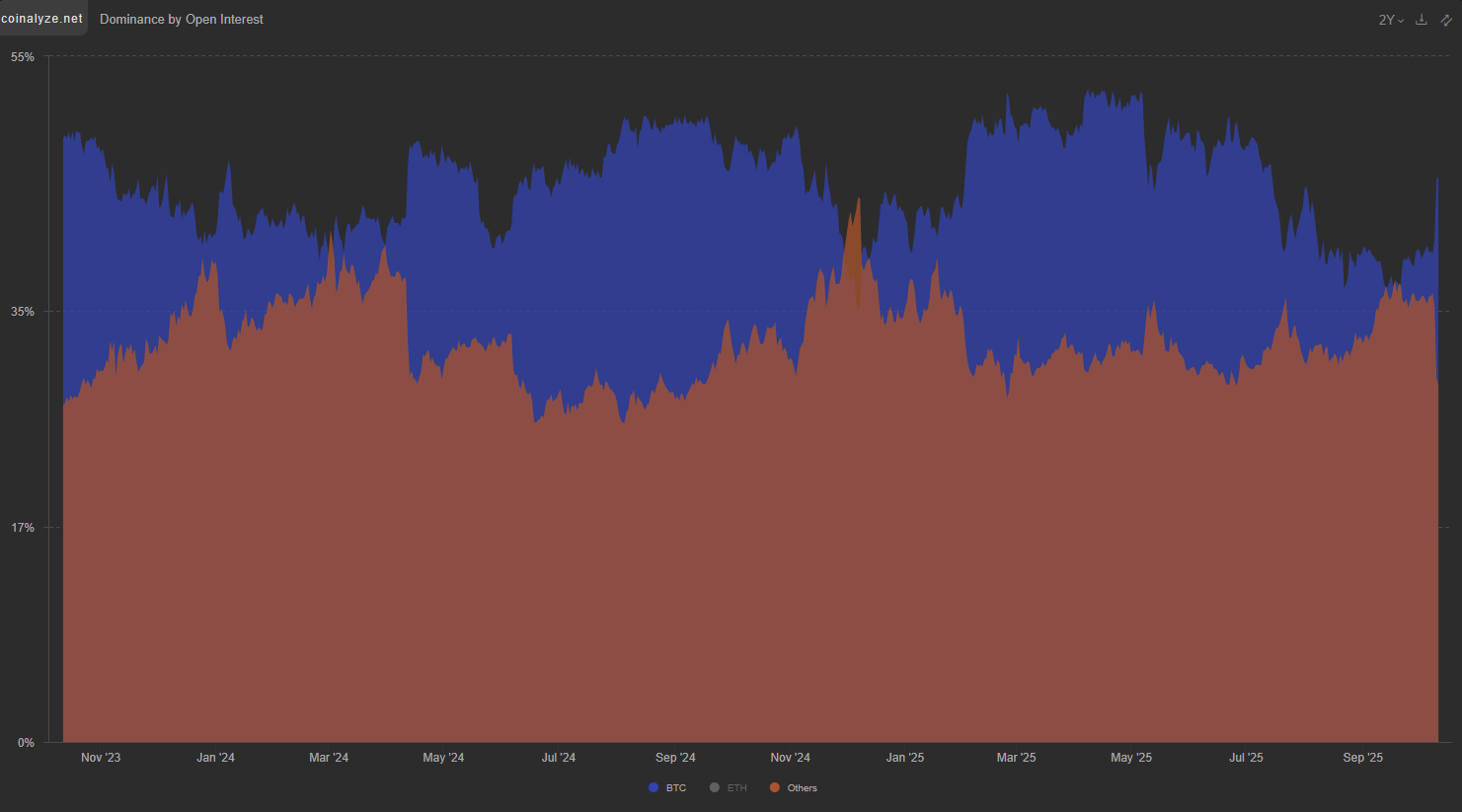

When Alt OI beats BTC’s, tops tend to follow

TL;DR: When altcoins’ open interest (OI) overtakes BTC’s, we’re usually in peak-euphoria territory. Cross-margining with alt collateral, the relentless proliferation of alt perps, and the widening list of alts accepted as collateral all make the system more reflexive: upside begets more buying power… until deleveraging snaps it back. It’s not a law, but it’s a reliable yellow light for risk.

The core read

Setup: Over the past ~2 years, episodes where Alt OI > BTC OI aligned closely with local tops in total crypto market cap.

Why it rhymes:

Behavioral: late-cycle FOMO into higher beta; vol feels tame; leverage and size creep up.

Mechanical: when the turn comes, alts gap first, liquidations domino, Alt OI collapses faster than BTC OI.

Collateral reflexivity (the cross-margin alt effect)

On many venues, traders can post alts as cross-margin collateral (sometimes under portfolio margin).

In uptrends, collateral marks up → account equity rises → more borrow/size available → Alt OI expands even without new external dollars.

In drawdowns, the process runs in reverse: price down → collateral down → margin ratio worsens → forced cuts/liqs → deeper price down.

This creates one-factor risk: your PnL and your collateral are driven by the same alt complex. Hedge or size for that correlation, not as if they’re independent.

Practical mitigants:

Prefer USD/stablecoin collateral for alt perps during frothy regimes.

If you must use alts as collateral, keep a haircut budget (e.g., assume −30–50% shock on collateral) and test if your margin holds.

Use isolated margin on the frothiest names; keep cross for BTC/ETH only.

More alt perps, more places to punt

Each cycle lists hundreds of new perp pairs (CEX + on-chain perps). Even without massive new capital, OI can fragment outward across new tickers and still print record totals.

Side effects:

Thin books: top-of-book depth per pair drops, making wicks and liq-cascades more violent.

Funding dispersion: crowded small caps exhibit sustained positive funding, a soft tell of late rotation.

Index hedging gets sloppier: alt baskets are harder to hedge with BTC; basis risk rises while traders think they’re diversified.

The “collateral whitelist” keeps widening

Venues periodically add more alts as eligible collateral (often with haircuts). That expands effective leverage at the portfolio level.

In euphoria, some platforms relax haircuts or users self-select toward venues with friendlier rules—again boosting OI reflexively.

Watch for: sudden collateral policy updates, and user migrations to venues with generous portfolio margin. Those are accelerants.

Alt open interest (red) vs BTC (blue). Alt OI peaks that surpass BTC have aligned with local market tops.

How I use the signal

Treat Alt OI > BTC OI as a context trigger, then layer confirmations:

Funding & basis: multiple alts > +0.05%/8h for days, perp premium over spot widening.

Breadth & dispersion: >50% of top alts at 20-day highs while BTC lags; realized vol of alts >> BTC.

Liquidity tells: thinner books, higher slippage on modest size, and rising liquidation density near price.

Stablecoin flows: flat to negative net issuance while OI climbs (leverage, not fresh cash).

Positioning playbook

Rotate up the quality curve (BTC/ETH) or cut gross while the signal is hot.

Hedge beta: cheap out-of-the-money BTC puts or short an alt index basket vs. your longs.

De-correlate collateral: move to stables; avoid stacking alt PnL + alt collateral.

Pre-plan exits: automate tiered de-risking on funding/vol/breadth triggers so you’re not deciding mid-cascade.

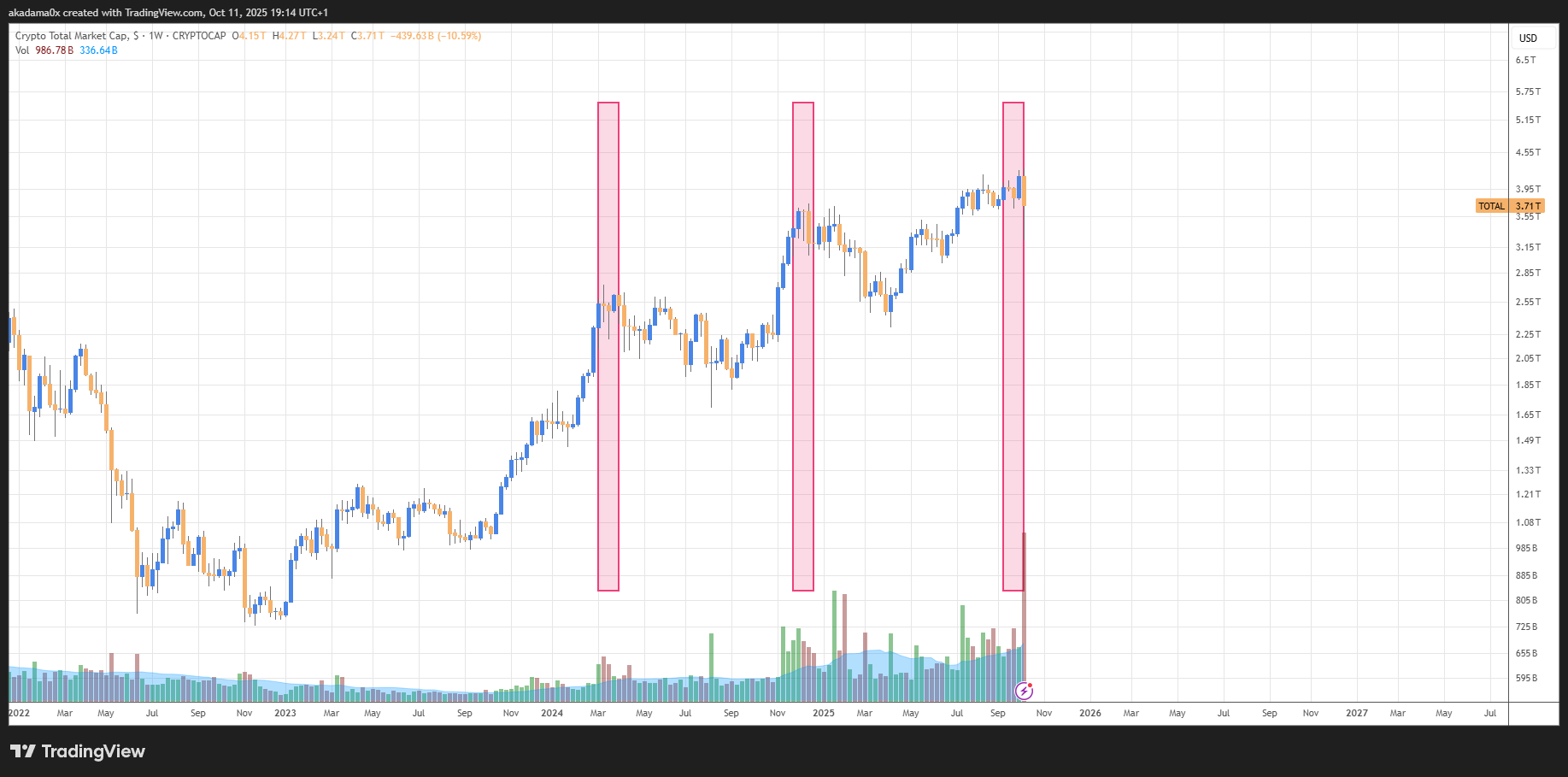

Total crypto market cap (1W). Shaded regions mark periods when Alt OI > BTC OI and the subsequent corrections.

Method notes & caveats

My clean read spans ~2 years (data limitations). Earlier cycles likely rhyme, but market structure (on-chain perps, portfolio margin) has changed, which can stretch timing.

Exogenous shocks (policy, ETFs, hacks) can overpower microstructure signals.

OI ≠ net long: some flows are hedges; still, late-cycle net positioning tends to skew long in alts.